Step-by-Step Process to Make An Application For Conventional Mortgage Loans

Step-by-Step Process to Make An Application For Conventional Mortgage Loans

Blog Article

A Comprehensive Guide to Getting Home Mortgage Loans and Navigating the Application Process Efficiently

Navigating the intricacies of protecting a home loan can usually really feel overwhelming, yet understanding key aspects can significantly enhance your possibilities of success. From reviewing your credit rating to choosing the most suitable lending institution, each step plays a vital duty in shaping your home loan application experience. As you prepare essential paperwork and engage with loan providers, it comes to be noticeable that tactical planning is paramount. The subtleties of the application procedure and ideas for guaranteeing authorization can make all the distinction in accomplishing beneficial terms. What steps should you prioritize to streamline your trip?

Understanding Your Credit Rating

A solid understanding of your credit history is important for navigating the home loan process effectively. Your credit report is a mathematical representation of your creditworthiness, normally ranging from 300 to 850, and it substantially influences the terms of your mortgage. Lenders depend on this score to assess the threat associated with lending you money.

Several elements add to your credit report, including payment background, credit usage, size of credit report, sorts of credit score accounts, and recent inquiries. Repayment history is one of the most vital element, as prompt repayments reflect your reliability as a borrower. Preserving a low credit scores application ratio-- preferably below 30%-- is additionally vital, as it shows accountable credit report administration.

Prior to getting a home mortgage, it is suggested to inspect your credit report for mistakes and contest any type of inaccuracies. Improving your rating can require time, so consider approaches such as paying down existing financial debts, avoiding brand-new credit score queries, and making payments promptly. By understanding and handling your credit history, you can enhance your opportunities of securing desirable home mortgage terms and ultimately achieving your homeownership objectives.

Picking the Right Lending Institution

Choosing the ideal lender is an essential step in the home loan process, especially after acquiring a clear understanding of your credit rating. The loan provider you choose can significantly impact your home loan experience, from the prices you obtain to the overall effectiveness of the application procedure.

Begin by investigating different lenders, consisting of traditional financial institutions, credit score unions, and online home mortgage business. Each kind of lending institution might supply unique benefits, such as affordable rates or personalized solution. Compare passion rates, fees, and loan items to identify loan providers that align with your economic demands.

Furthermore, think about the lending institution's track record and client service. Read testimonials and ask for referrals from pals or family. A loan provider with a solid track document of customer contentment can provide beneficial assistance throughout the process.

It is likewise important to evaluate the lending institution's responsiveness and determination to answer your concerns (Conventional mortgage loans). A communicative and clear loan provider can help reduce anxiety during this critical time. Eventually, selecting the right loan provider will certainly improve your home loan experience, ensuring you safeguard favorable terms and a smooth application procedure

Preparing Necessary Documentation

Gathering needed documentation is critical for a smooth mortgage application procedure. The right documents provide lending institutions with a thorough sight of your monetary circumstance, helping with quicker authorizations and lessening possible hold-ups.

Furthermore, it's essential to collect info concerning your debts, including charge card statements and any exceptional finances, to provide loan providers a full photo of your economic obligations. Documents associated to the home you desire to refinance or acquire, such as an implemented acquisition arrangement or building listing, need to likewise be consisted of.

Being well-prepared can substantially improve your home loan application experience, guaranteeing that you offer a complete and accurate economic account to potential loan providers.

The Home Mortgage Application Process

Once the application is sent, the lending institution will initiate a debt check to assess your wikipedia reference credit history and history. Concurrently, they might ask for added documentation to confirm your earnings, properties, and responsibilities - Conventional mortgage loans. This might include recent pay stubs, bank statements, and tax obligation returns

After evaluating the application and supporting records, the lending institution will release a Lending Price quote, detailing the terms, interest rates, and charges connected with the loan. This is an important paper for contrasting deals from different lenders.

Following your approval of the Car loan Quote, the lender will perform a residential or commercial property assessment to determine the home's value. Once all problems are fulfilled, the lending will continue to underwriting, where the final choice on approval will be made. Recognizing these steps is crucial for a smooth home loan application procedure.

Tips for a Successful Authorization

Next, arrange your financial documents. Collect pay stubs, tax returns, bank statements, and any kind of other pertinent paperwork that shows your revenue and financial stability. This will simplify the application process and show lending institutions that you are a responsible customer.

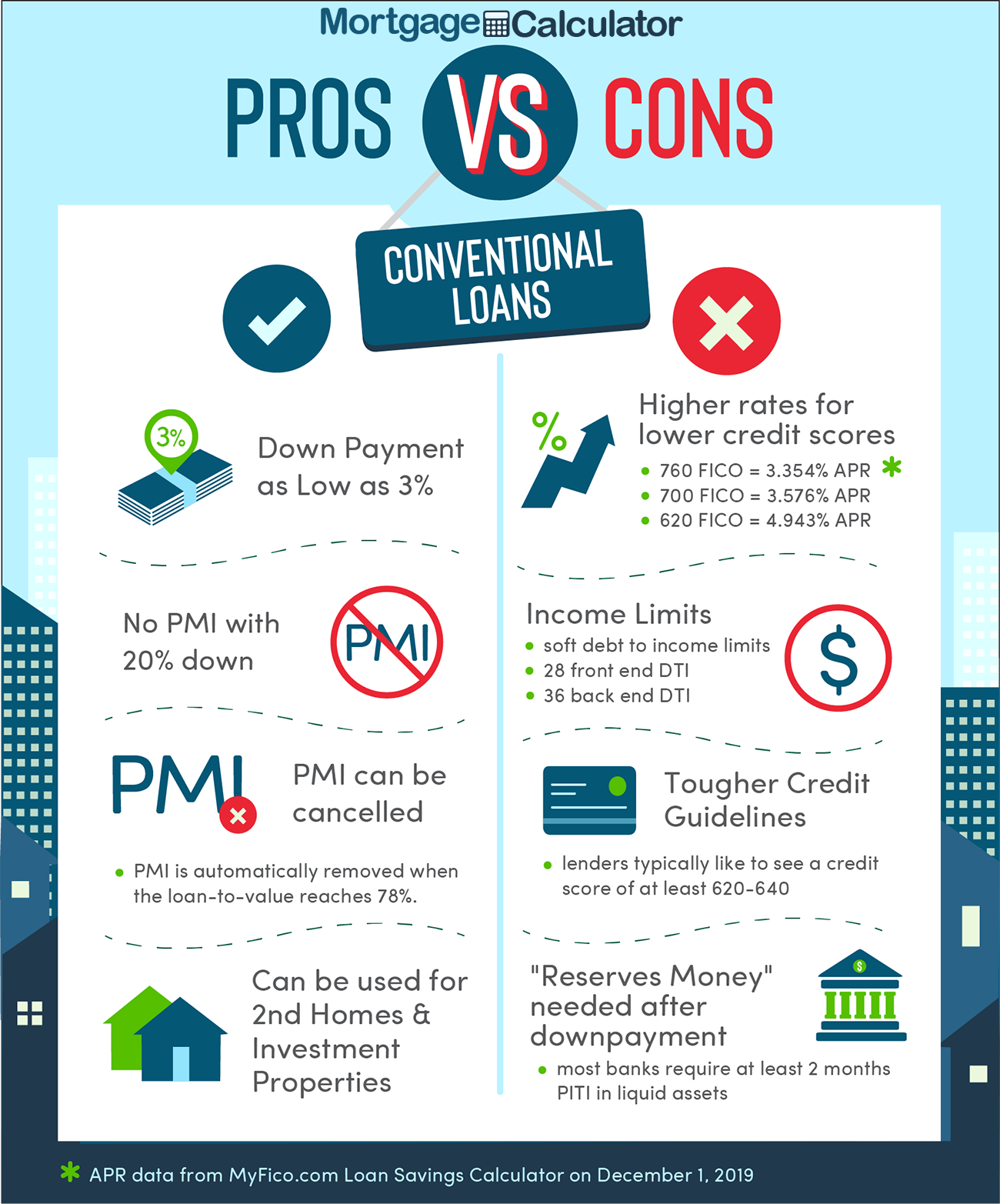

Additionally, consider your debt-to-income (DTI) proportion. Lenders prefer a DTI of 43% or lower, so concentrate on paying browse around these guys for existing financial debts to enhance your financial profile. It may also be useful to save for a bigger down repayment, as this can lower your monthly repayments and demonstrate your commitment.

Lastly, maintain open lines of interaction with your loan provider. Ask concerns to make clear any type of uncertainties and remain educated concerning your application's development. By being positive and well-prepared, you can navigate the home loan approval process with confidence and raise your probability of success.

Final Thought

To conclude, protecting a home mortgage car loan requires an extensive understanding of various parts, consisting of credit rating, lender option, and documents preparation. Browsing the application procedure efficiently enhances the probability of approval and desirable terms. By sticking to these guidelines and keeping open communication with lending institutions, possible customers can position themselves for success. A critical method ultimately results in better financial results in the pursuit of homeownership.

From reviewing your credit history score to picking the most suitable loan provider, each action plays a critical function in forming your home mortgage application experience.Begin by investigating different lending institutions, consisting of traditional financial institutions, credit unions, and on the internet mortgage companies. Inevitably, selecting the right loan provider will certainly improve your home loan experience, ensuring you secure beneficial terms and a smooth application procedure.

The process typically starts with choosing a lender and completing a home loan application, which consists of individual, economic, and work information.In final thought, securing a home mortgage loan requires a comprehensive understanding of various parts, consisting of debt scores, loan provider choice, and documents preparation.

Report this page